Unemployment insurance tax calculator

Base Tax Rate for 2022 from 050 to 010. If an employee makes 60000 their.

Unemployment Insurance Rate Information Department Of Labor

This taxable wage base is 62500 in 2022.

. Unemployment Compensation Subject to Income Tax and Withholding The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums. Unemployment Insurance UI tax and Employment Training Tax ETT are calculated up to the UI taxable wage limit of each employees wages per year and are paid by the employer. Your employer withholds a 62 Social Security tax and a.

The calculator automatically determines the relevant quarters for your base period when you enter the date your claim was filed. Ad Use Our Free Powerful Software to Estimate Your Taxes. File Wage Reports Pay Your Unemployment Taxes Online.

See How Easy It Is. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. In this easy-to-use calculator enter your.

If an employee makes 18000 per year their taxable wage base is 18000 and their employer calculates SUTA based on this amount. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer. Weekly Benefit Rate Calculator.

The federal unemployment taxes paid to the Internal Revenue Service Form IRS 940 are used to pay the costs of administration of the unemployment insurance and Job Service programs in. Get an estimate of your Unemployment Insurance Weekly Benefit Rate should you become unemployed. Number of employees Average annual salary per employee State your business is headquartered in Current SUI rate Possible SUI rate.

To calculate the amount of unemployment insurance tax. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Unemployment insurance 493 Income tax 5752 You pay 34 14085 You keep 66 27015 The taxes you pay in Germany All German residents must pay taxes in.

If you are affected by military service industrial. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Simply enter the calendar year your premium.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. Additional Assessment for 2022 from 1400 to 000.

Special Assessment Federal Loan Interest Assessment for 2022 from 180 to. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. Weekly Benefit Rate Calculator.

IRS approved e-file provider.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Calculate Unemployment Tax Futa Dummies

Jquery Tax Calculator Plug In For Financial Websites

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

Futa Tax Overview How It Works How To Calculate

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

How To Get A Refund For Taxes On Unemployment Benefits Solid State

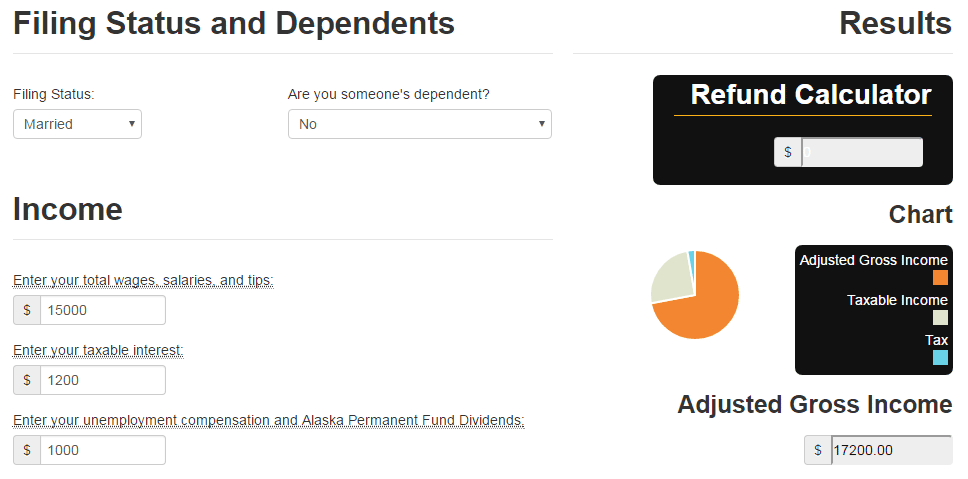

Tax Calculator For Income Unemployment Taxes Estimate

Payroll Tax Calculator For Employers Gusto

Tax Calculator For Income Unemployment Taxes Estimate

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

Tkngbadh0nkfnm

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor